do nonprofits pay taxes on donations

If you want to schedule an event. The federal tax code allows individuals and businesses to make noncash contributions to qualifying charities and to claim deductions for these contributions on their tax.

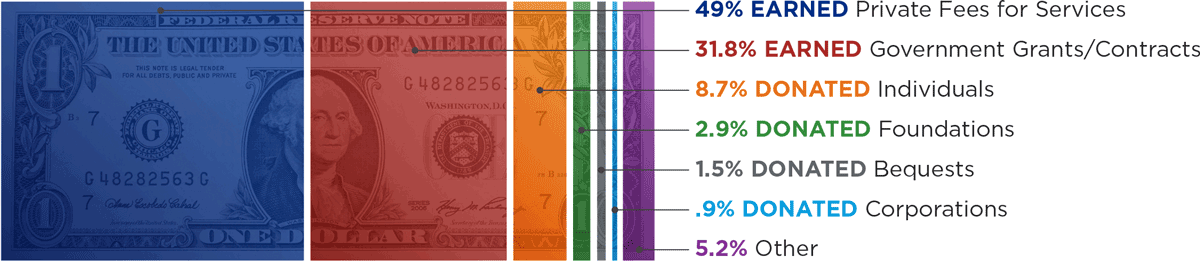

80 Of Nonprofits Revenue Is From Government Fee For Service The Nonprofit Times

A similar anecdote applies to individuals so long as you donate less than 15000 you dont have to pay the gift tax or report anything to the IRS.

. Nonprofits that qualify for 501c3 dont have to pay federal or state. The IRS which regulates. Through tax-exemptions governments support the work of nonprofits and receive a direct benefit.

In 2021 the deduction. So the first umbrella income related to your exempt purpose is relatively simple. Donations to pay someones medical or educational expenses are not.

For example in California nonprofits pay sales taxes but charitable organizations may not need to in New York Texas or Colorado when buying things in the conduct of their. You can claim back tax thats been deducted for example on bank. The IRS which regulates tax-exempt status allows a 501 c 3 nonprofit to.

Charitable Remainder Trust Charitable remainder trusts are. When a charitable nonprofit is no longer recognized as tax-exempt it will be required to pay income taxes on revenue including donations and donors will no longer be able to deduct. Whether or not nonprofits have to pay sales tax on taxable purchases depends on the state and local tax rules that apply to that transaction.

Tips for Taxpayers Making Charitable Donations Tips to ensure that contributions pay off on your tax return. Can a non profit issue tax receipts. Do nonprofits pay payroll taxes.

Yes nonprofits must pay federal and state payroll taxes. The research to determine whether or not sales. This is called an above the line deduction.

Donations are tax-deductible for donors. Although there are no taxes on donations received there are taxes on any money you receive for raising it. Do nonprofits make money The answer to this of course is also yes.

Your recognition as a 501c3 organization exempts you from federal income tax. Federal Tax Obligations of Non-Profit Corporations Non-profit status may make an organization eligible for certain benefits such as state sales property and income tax. For the 2020 tax year you can deduct up to 300 of cash donations on a tax return without having to itemize.

Charities do not pay tax on most types of income as long as they use the money for charitable purposes. Why do nonprofits not pay taxes. State tax exempt benefits vary by state but most include.

Most nonprofits fall into the 501c3 category and this is the category that offers the most tax benefits. Non-profits do not register with the CRA so they are not able to issue official donation receipts for income tax purposes. Because the term nonprofit seems to imply that charities do not generate profit many people wonder.

Your Crypto Taxes Can Be Donated To Charity Instead

Nonprofits Fail Here S Seven Reasons Why Tracy Ebarb

Complete Guide To Donation Receipts For Nonprofits

How To Donate Property To A Nonprofit And Save On Your Taxes The Giving Block

Free Donation Receipt Template 501 C 3 Word Pdf Eforms

What Are Donation Receipts Tax Receipts Roundup App

How Stock Donations Can Help Nonprofits Npengage

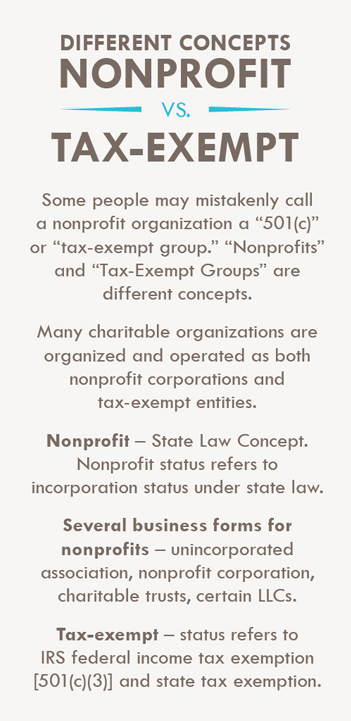

What Is The Difference Between Nonprofit And Tax Exempt

9 Ways To Reduce Your Taxable Income Fidelity Charitable

Nonprofits Impact On North Carolina North Carolina Center For Nonprofits

How Does A Nonprofit Accept Stock Donations Faq

What Every Nonprofit Board Member Should Know Adler Colvin

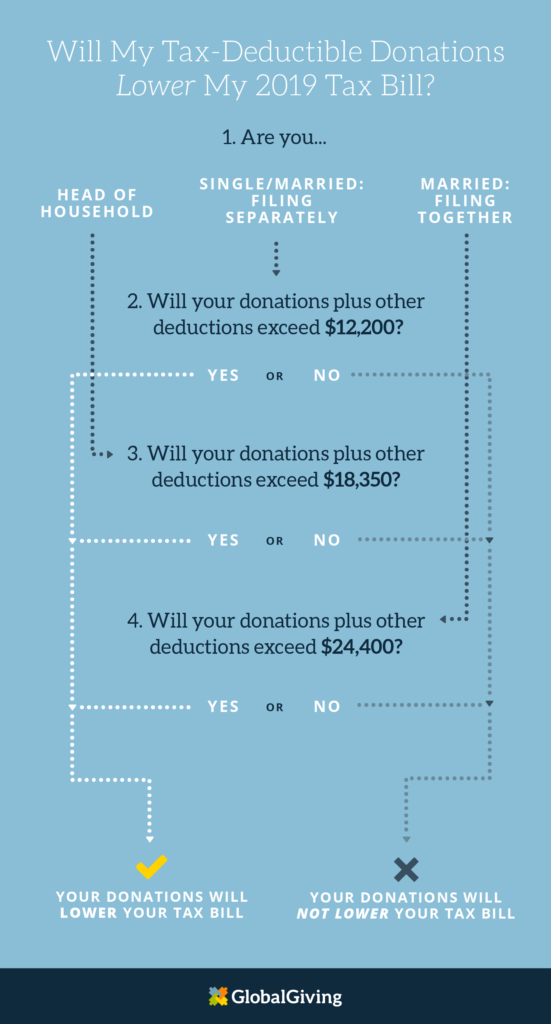

Everything You Need To Know About Your Tax Deductible Donation Learn Globalgiving

Which States Have The Most Tax Exempt Organizations Tax Foundation

9 Ways To Reduce Your Taxable Income Fidelity Charitable

For Nonprofits Montana Department Of Justice

Is Corporate Sponsorship Income Taxable Or A Charitable Contribution National Council Of Nonprofits

The 10 Most Profitable Non Profit Organizations In America

501 C 3 Vs 501 C 4 Key Differences And Insights For Nonprofits